Anyone who had to make decisions involving the fate of a huge sum of money, would give a lot in order to know the exact consequences of these decisions. After all, a lot of money is a huge responsibility. Some of those wrong decisions may turn out fatal to the financial future of a company and its shareholders. Therefore it is very important to carefully calculate all the financial variables of a project, but this task is a laborious process. Luckily, there is a number of programs available on the market to make all of those calculations practically feasible, and Systematic Business Calculator is one of them.

This software package allows you to play different "what-if" scenarios. This will help you to quickly disregard alternatives with bad or unsatisfactory performance data and leave you with scenarios that will hopefully result in a happy ending.

By adjusting various variables of a project inside the program, you can observe the consequences of certain decisions or track changes in external factors. The benefit of this program is that you don't gamble with a grand sum of money. You get to execute as many scenarios as you wish to make sure that your chosen alternative will lead to the expected result.

The Systematic Business Calculator is exactly what any financial manager needs. It creates a model which simulates the activity of the whole company.

This financial tool has two main purposes:

1. it visualizes all of the company's financial activities in the form of cash flows;

2. it calculates variables to indicate the impact of certain decisions.

In other words, it provides comprehensive financial models for forecasting, cash flows, ratio analysis and other numerous evaluation methods.

The package has six major tools:

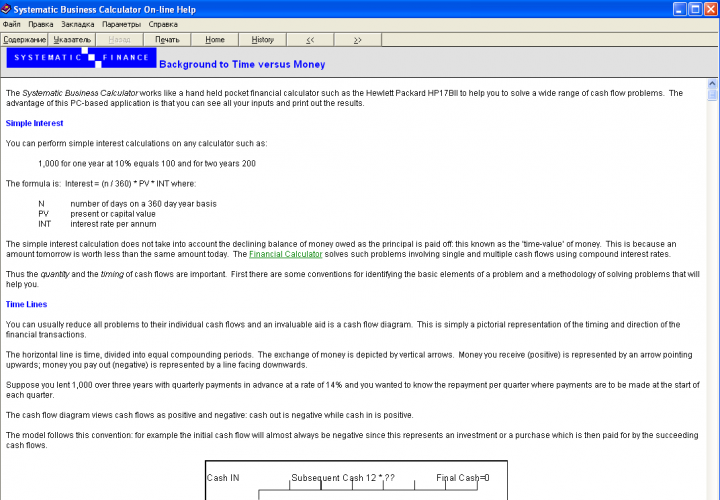

1. Financial calculator solves complicated "The time versus Money" problems.

2. Quick calculator computes cash flow and calculates interest rates.

3. Amortization schedule lets you view the project's detailed payment profile.

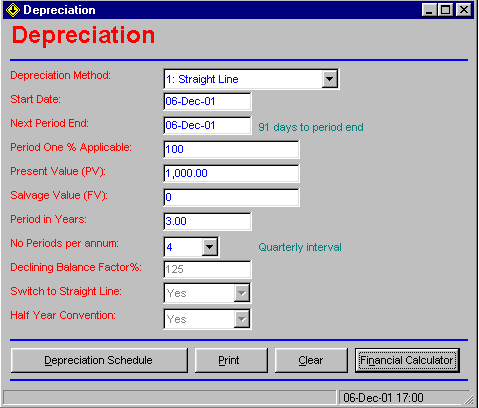

4. Depreciation function includes four methods: straight line, sum of digits, declining balance and accelerated cost recovery.

5. Discounted cash flows calculate Interest Rate (IRR) , Present Value (NPV), Payment Interval (PI), Payback Period (PP), Accounting Return (ARR) and Margin Reinvestment Rate (MIRR). The program allows up to ten sets of cash flows.

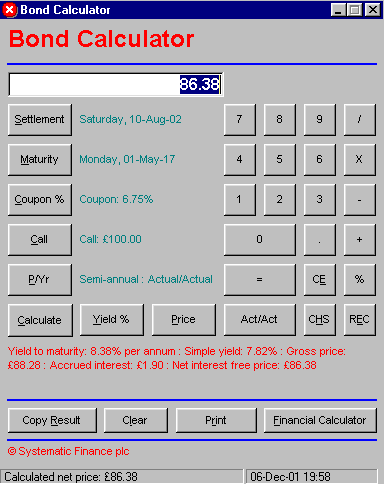

6. Bonds calculator computes the price and yield of your financial instruments.

All in all, the program is excellent for advanced financial modeling and "what-if" scenarios. It has a clear input screen which displays the dates of the cash flows together with their values. Hence, input errors will be reduced to a minimum. In addition, there is a way to see all of the variables in one place, which might give you the understanding of the problem and thus give you a clear idea of the solution. All your work in the Systematic Business Calculator is automatically saved for future use.

Moreover, the program can also facilitate learning as it provides comprehensive help files (background and glossary) with many examples and explanations. Thereby this easy-to-use tool can assist students and course attendees as well.

Please also note that some input boxes may be grayed out. The program automatically disables variables that are not needed for a particular task at hand. Also, the application automatically checks your inputs and will let you know if you have errors or more variables are required for calculations. And of course you can always print any of your results for future reference.

Evaluation copy of the program is valid for 14 days - quite enough time to appreciate advantages of this indispensable tool and to subsequently buy it.